Oncology care is complex and daunting. Any changes in how cancer care is delivered should always consider its impact on the patient experience.Transitions of care that are the result of network provider changes can negatively impact this experience. Traditionally, transitions of care involve moving patients from one provier to another. Transitions in care can alternatively be seen as moving patients from a fee-for-service (FFS) model to value-based care. OPN regularly transitions populations this way. Migrating oncology care from legacy FFS delivery systems to value-based care can be successfully navigated through flexibility, innovation and contingency planning

There is never a single turnkey solution for accommodating transitions of care. Every market is different, and a successful transition requires collaboration, regular monitoring and incremental adjustments. This study reviews three examples of a transition in coverage to OPN network providers. Though these all took place in geographic proximity to each other, each market required unique, bespoke solutions to implement a provider transition with minimal negative impacts on the patient experience.

Transition Issues

Facilitating patient care transitions is challenging given the complex nature of oncology cases, including frequent office visits, screenings, and treatment regimens. This includes utilizing appropriate lab testing and diagnostic screenings and determining up-front what appropriate treatment regimens should be. Understanding the mechanics of migrating oncology care from an FFS model to a value model is necessary for a successful payer and provider transition.

Maintaining and Increasing Network Coverage

Preserving network coverage to assure continuity of care is critical. During a contract switch current providers will be maintained and should be integrated into the OPN network. A trial period for these current providers is often arranged during integration to see how well they can adapt to the network model. If necessary, additional providers will potentially be overlaid. Once the requisite providers are in place, the network usually requires optimization to decrease costs while maintaining accessibility for patients including in-network second opinions. This program is meant to serve as a support system for providers in treatment planning, and does not mandate pathways or deny services. Over time practice referrals will be directed to high performing providers.

Provider Engagement and Education

Once previous providers are integrated into the network, it is imperative to communicate regularly and effectively to them what is considered current and appropriate treatment via data and sub-specialist expertise. OPN employs several proprietary tools that can assist in clinical decision making with actionable data analytics. This is complemented by the support of peer-to-peer sub-specialist networks who work with the OPN’s Care Management Services program to assist all network providers.

A key component of these efforts is educating physicians on the methods and nuances Alternative Payment Models (APMs) such as capitation, gain share and risk pool reimbursement. The biggest obstacle in successfully engaging these providers hinges on the revenue stream. It is more easily adopted by those providers when this is a new revenue stream. When it disrupts a current revenue stream such engagement is often met with resistance.

Health Plan and Risk Bearing Organization Alignment

Not only do providers need to be engaged, but so do health plans. For example, their experience with capitation may be limited, and they may not have in-place systems to pay capitation. There is also a common concern that any move to APMs will alienate existing providers, creating oncology patient backlash. It is necessary to assess the willingness of migrating FFS to value-based care delivery for these plans and how aggressive they are willing to be. Most prominent is how to maintain a positive patient experience regarding transitions of care, patient satisfaction, and provider accessibility.

Focus on Patient Care

Above all, there is a focused consideration of the patient. Any transition needs to consider how an action can impact patient care and the patient experience. Every attempt is made to avoid patient transitions to a new provider at almost any cost. Continuity of care guidelines are followed rigorously, and all active patients remain with their current provider unless they opt for new network providers. Patient care coordinators (PCC) are also deployed to make sure that all transitions are as seamless as possible. These PCCs help streamline the patient experience and support efficient practice level operations by facilitating the transfer of documents, patient coordination and other supportive roles.

Markets Require Bespoke Approaches

Single Provider with High Leakage

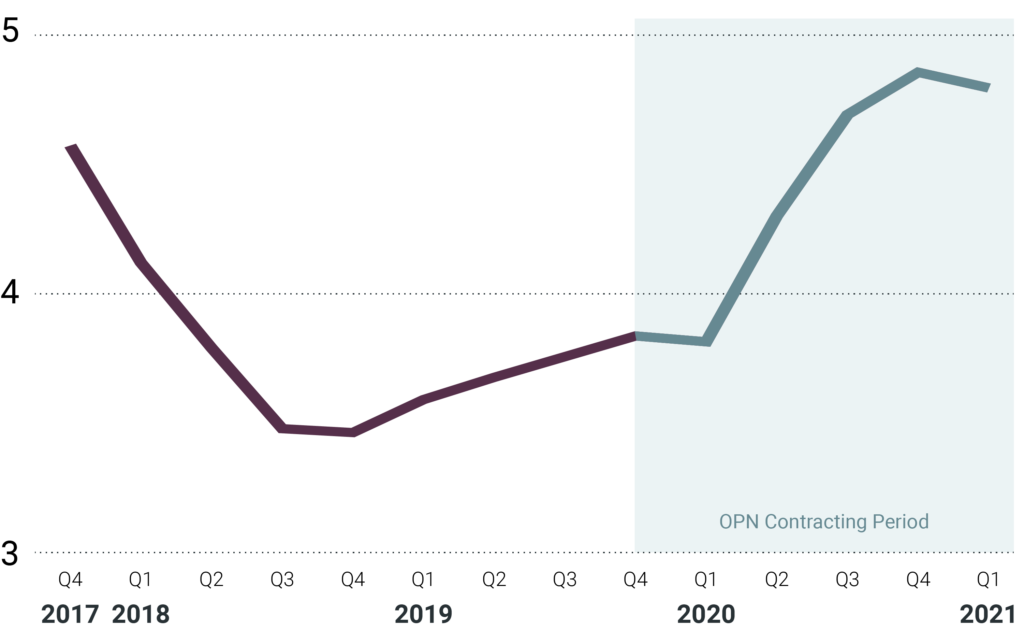

In less dense areas, a single oncology practice is often responsible for the cancer care of an area’s population. A client approached OPN because there was significant oncology patient dissatisfaction with the single provider in one market which resulted in approximately 40% network leakage. The practice was partially capitated for professional costs only, but not for drug costs. OPN maintained the provider relationship, but also integrated additional new providers who currently work in the OPN network close by. Such an integration and network overlay approach led to increased provider access for the population. Additionally, primary care provider (PCP) satisfaction scores rose from the mid threes before the new model was implemented to high fours within 2 years (see figure 1), and network leakage dropped to less than 5%. OPN consistently has the highest PCP satisfaction scores for all specialties related to the health plan in this market. The strategy yielded better patient outcomes, higher quality and lower population costs.

Oligopoly Provider with High Oncology Costs

Like the previous case, this region had one main oncology care provider that treated most cancer patients in the area. The challenge in this circumstance was that utilization was much higher than comparable practices in other areas due to the FFS-structured contract. An initial trial period to integrate the existing current provider was implemented. Unfortunately, neither the health plan nor the provider experienced satisfactory outcomes. Subsequently, a new market provider was brought in under a full value-based model including payer capitation and provider APMs. With the new provider in place for two years, oncology costs for that market were reduced by nearly 75% with little to no patient complaints (see figure 2).

High Patient Population Density Area

Dense population markets present a different challenge for oncology care. As the patient population grew, there was a need to increase service in this area. Provider availability and choice weigh heavily on patient satisfaction. To accomplish this there was an overlay of new providers utilizing a provider group with multiple offices in the area that had a long experience with alternative payment models. Four new physical offices with five new physicians were added to the network. Coverage was more than doubled and there were no patient or PCP complaints. This opportunity was well received by the provider group as it represented a new revenue stream for the office. Their understanding of alternative payment models resulted in an almost seamless transition that improved patient access and quality of care.

Conclusion

Value-based oncology care has much to offer from a perspective of sustainability. With the high variability of oncology costs and risks associated to a medical group, alternative payment models can mitigate them. Each market is different, so there is no simple turn-key solution to implementing these models. It requires flexibility and expertise to ensure adherence to cost and care goals that prioritizes the patient population.